What are the key new European regulations on the environment, sustainable development and CSR in 2024?

Discover our overview of the 2024 European CSR regulations and the main tax, reporting, legal and strategic implications for European companies.

When it comes to ESG, 2024 will see important “regulatory firsts” for Europe and its companies. Not without any repercussions beyond the borders of the European Union.

Throughout 2023, we followed the entry into the test phase of the CBAM, the new carbon tax at the borders of the European Union, the publication of the new European Sustainability Reporting Standard (ESRS), the developments of the first European directive on corporate sustainability due diligence (CSDDD), and the definition of new environmental criteria to be met for a business activity to be ‘green’.

First part of the overview of the 2024 European CSR regulations: the carbon tax on imports.

The first declarations on the application of the carbon tax at Europe’s borders will be published at the beginning of 2024.

Which sectors must apply the CBAM?

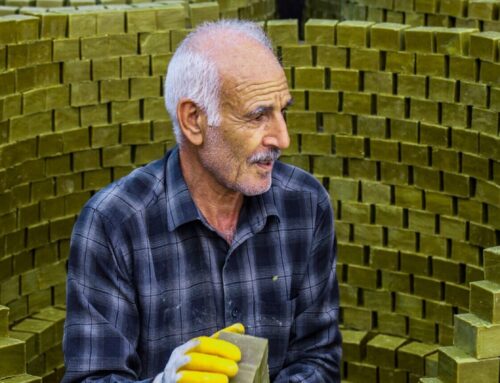

Designed as a protective mechanism for European industry, the CBAM is intended to operate in conjunction with the European Union Emissions Trading Scheme. The CBAM targets imports of products in carbon-intensive industries. This new tax, which sets a carbon cost for imports of certain products into the European Union, entered its transition phase on 1st October 2023. Until 2026, the CBAM will apply to the following imports: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

Since October 2023, the importers have been collecting data on the greenhouse gas emissions caused by the production of these goods. They will publish their first declaration covering the fourth quarter of 2023 by 31st January 2024.

What is the estimated cost of this European carbon tax on imports?

No financial adjustments will apply during this transition period. When the final period begins in 2026, importers will have to purchase and transfer “CBAM certificates”, corresponding to the greenhouse gas emissions caused by an imported product.

However, in our article Exports / Imports: prepare to comply with the MACF (CBAM)! we reveal that, according to our estimates, the additional cost for an imported product can be as much as 50% of its value.

The first declarations on the application of the carbon tax at Europe’s borders will be published at the beginning of 2024.

Until 2026, the CBAM will apply to the following imports: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

Second part of the overview of the 2024 European CSR regulations: transparency requirements at their highest.

The European directive on sustainability reporting will apply to companies in a phased manner. Which companies are covered by the CSRD in 2024?

The first reporting year of the Corporate Sustainability Reporting Directive (CSRD) opens for large European and non-European companies subject to the publication of non-financial statements.

Having come into force since 1st January 2024, the Directive (EU) 2022/2464 on the publication of sustainability information by companies (CSRD) introduces mandatory ESG reporting standards for all large companies. These companies will have to provide improved, formatted and audited non-financial reports every year. These reports must respect the principle of double materiality.

The new directive will be applied in stages, to give companies time to comply. The first companies to be affected are European public interest entities and non-European companies listed on European markets meeting the following 2 criteria:

- > 500 employees

- Turnover > €50m and/or balance sheet total > €25m.

These players will collect the extra-financial data required by the CSRD during the course of 2024, and will publish their first reporting in line with the directive at the beginning of 2025, within a dedicated section of the company’s annual report, according to the new European Sustainability Reporting Standards (ESRS).

The first reporting year of the Corporate Sustainability Reporting Directive (CSRD) opens for large European and non-European companies subject to the publication of non-financial statements.

Third part of the overview of the 2024 European CSR regulations: the new Sustainability Due Diligence directive.

With regard to the final text of the Corporate Sustainability Due Diligence Directive (CSDDD it will be formally adopted following the agreement reached by legislators on the future European directive. Undeniably, it will have implications for the management of human rights and environmental risks by companies.

To which companies will the future European directive on corporate sustainability due diligence apply?

On 14th December 2023, the European institutions reached an agreement on this text. The text will require major companies to draw up due diligence plans throughout their value chain. The objective of the due diligence plan is to prevent the risk of human rights and environmental abuses.

According to the agreement reached, the future directive will apply to the following companies:

- European companies meeting the following 2 criteria:

-

- > 500 employees

- Turnover > €150m

- European companies operating in high-impact sectors (textiles, agriculture, foodstuffs, mining, construction) and meeting the following 2 criteria:

-

- > 250 employees

- Turnover > 40M€

- Third-country companies with sales in Europe

- > €150m,

- 3 years after the directive comes into force.

The European Commission will publish a list of the non-European companies concerned.

Is the financial sector affected?

For the time being, the financial sector is excluded from the scope of the CSDDD. A review clause is provided for the potential inclusion of this sector following an impact study.

What remedies and sanctions does the CSDDD provide for in the event of human rights or environmental abuses?

The future directive provides for a civil liability regime to facilitate claims for compensation. Individuals, trade unions and NGOs will have five years of the observed breach to assert their rights.

Violations of the directive will result in administrative penalties of up to 5% of turnover. Compliance with the due diligence duty may also constitute a criterion for the award of public contracts and concessions.

The compromise reached by the co-legislators also strengthens the climate-means obligation for large companies, which are required to adopt a transition plan compatible with the Paris Agreement. While the CSRD obliges these companies to publish a transition plan, the CSDDD sets out the obligation to put this plan into action.

Once the compromise text has been formally adopted and published in the EU’s Official Journal, Member States will have two years to transpose it into national law.

The final text of the Corporate Sustainability Due Diligence Directive (CSDDD) will be formally adopted following the agreement reached by legislators on the future European directive.

While the CSRD obliges these companies to publish a transition plan, the CSDDD sets out the obligation to put this plan into action.

Fourth part of the overview of the 2024 European CSR regulations: the green taxonomy.

The provisions of the four non-climatic environmental objectives of the European taxonomy came into force on 1st January 2024.

In June 2023, the European Commission adopted a delegated act including the criteria of its taxonomy for economic activities contributing to one or more of the non-climate environmental objectives:

- the sustainable use and protection of water and marine resources,

- the transition to a circular economy,

- pollution prevention and control,

- and the protection and restoration of biodiversity and ecosystems.

Entities covered by the European taxonomy will have to report on the eligibility of their activities or investments for these four new environmental objectives from 2024. Then they will report on their degree of alignment from 2025.

In 2024, European companies must apply for the first time a whole set of European CSR regulations. A historical push with the purpose of encouraging a more responsible business conduct.

The provisions of the four non-climatic environmental objectives of the European taxonomy came into force on 1st January 2024.

What are the key new European regulations on the environment, sustainable development and CSR in 2024?

Discover our overview of the 2024 European CSR regulations and the main tax, reporting, legal and strategic implications for European companies.

When it comes to ESG, 2024 will see important “regulatory firsts” for Europe and its companies. Not without any repercussions beyond the borders of the European Union.

Throughout 2023, we followed the entry into the test phase of the CBAM, the new carbon tax at the borders of the European Union, the publication of the new European Sustainability Reporting Standard (ESRS), the developments of the first European directive on corporate sustainability due diligence (CSDDD), and the definition of new environmental criteria to be met for a business activity to be ‘green’.

The first declarations on the application of the carbon tax at Europe’s borders will be published at the beginning of 2024.

Until 2026, the CBAM will apply to the following imports: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

First part of the overview of the 2024 European CSR regulations: the carbon tax on imports.

The first declarations on the application of the carbon tax at Europe’s borders will be published at the beginning of 2024.

Which sectors must apply the CBAM?

Designed as a protective mechanism for European industry, the CBAM intends to operate in conjunction with the European Union Emissions Trading Scheme. The CBAM targets imports of products in carbon-intensive industries. This new tax, which sets a carbon cost for imports of certain products into the European Union, entered its transition phase on 1st October 2023. Until 2026, the CBAM will apply to the following imports: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

Since October 2023, the importers of have been collecting data on the greenhouse gas emissions caused by the production of these goods. They will publish their first declaration covering the fourth quarter of 2023 by 31st January 2024.

What is the estimated cost of this European carbon tax on imports?

No financial adjustments will apply during this transition period. When the final period begins in 2026, importers will have to purchase and transfer “CBAM certificates”, corresponding to the greenhouse gas emissions caused by an imported product.

However, in our article Exports / Imports: prepare to comply with the MACF (CBAM)! we reveal that, according to our estimates, the additional cost for an imported product can be as much as 50% of its value.

The first reporting year of the Corporate Sustainability Reporting Directive (CSRD) opens for large European and non-European companies subject to the publication of non-financial statements.

Second part of the overview of the 2024 European CSR regulations: transparency requirements at their highest.

The European directive on sustainability reporting will apply to companies in a phased manner. Which companies are covered by the CSRD in 2024?

The first reporting year of the CSRD opens for large European and non-European companies subject to the publication of non-financial statements.

Having come into force since 1st January 2024, the Directive (EU) 2022/2464 on the publication of sustainability information by companies (CSRD) introduces mandatory ESG reporting standards for all large companies. These companies will have to provide improved, formatted and audited non-financial reports that respect the principle of double materiality.

The new directive will be applied in stages, to give companies time to comply. The first companies to be affected are European public interest entities and non-European companies listed on European markets meeting the following 2 criteria:

- > 500 employees

- Turnover > €50m and/or balance sheet total > €25m.

These players will collect the non-financial data required by the CSRD during the course of 2024. They will publish their first sustainability report in compliance with the directive at the beginning of 2025. The sustainability report forms part of a dedicated section of the company’s annual report. The sustainability report comply with the new European Sustainability Reporting Standards (ESRS).

The final text of the Corporate Sustainability Due Diligence Directive (CSDDD) will be formally adopted following the agreement reached by legislators on the future European directive.

While the CSRD obliges these companies to publish a transition plan, the CSDDD sets out the obligation to put this transition plan into action.

Third part of the overview of the 2024 European CSR regulations: the new Sustainability Due Diligence directive.

With regard to the final text of the Corporate Sustainability Due Diligence Directive (CSDDD) it will be formally adopted following the agreement reached by legislators on the future European directive. Undeniably, it will have implications for the management of human rights and environmental risks by companies.

To which companies will the future European directive on corporate sustainability due diligence apply?

On 14th December 2023, the European institutions reached an agreement on this text, which will require major companies to draw up due diligence plans throughout their value chain. The objective of the due diligence plan is to prevent the risk of human rights and environmental abuses.

According to the agreement reached, the future directive will apply to the following companies:

- European companies meeting the following 2 criteria:

-

- > 500 employees

- Turnover > €150m

- European companies operating in high-impact sectors (textiles, agriculture, foodstuffs, mining, construction) and meeting the following 2 criteria:

-

- > 250 employees

- Turnover > 40M€

- Third-country companies with sales in Europe

- > €150m,

- 3 years after the directive comes into force.

The European Commission will publish a list of the non-European companies concerned.

Is the financial sector affected?

For the time being, the financial sector is excluded from the scope of the CSDDD. A review clause is provided for the potential inclusion of this sector following an impact study.

What remedies and sanctions does the CSDDD provide for in the event of human rights or environmental abuses?

The future directive provides for a civil liability regime to facilitate claims for compensation. Individuals, trade unions and NGOs will have five years of the observed breach to assert their rights.

Violations of the directive will result in administrative penalties of up to 5% of turnover. Compliance with the due diligence duty may also constitute a criterion for the award of public contracts and concessions.

The compromise reached by the co-legislators also strengthens the climate-means obligation for large companies, which are required to adopt a transition plan compatible with the Paris Agreement. While the CSRD obliges these companies to publish a transition plan, the CSDDD sets out the obligation to put this plan into action.

Once the compromise text has been formally adopted and published in the EU’s Official Journal, Member States will have two years to transpose it into national law.

The provisions of the four non-climatic environmental objectives of the European taxonomy came into force on 1st January 2024.

Fourth part of the overview of the 2024 European CSR regulations: the green taxonomy.

The provisions of the four non-climatic environmental objectives of the European taxonomy came into force on 1st January 2024.

In June 2023, the European Commission adopted a delegated act including the criteria of its taxonomy for economic activities contributing to one or more of the non-climate environmental objectives:

- the sustainable use and protection of water and marine resources,

- the transition to a circular economy,

- pollution prevention and control,

- and the protection and restoration of biodiversity and ecosystems.

Entities covered by the European taxonomy will have to report on the eligibility of their activities or investments for these four new environmental objectives from 2024. Then they will report on their degree of alignment from 2025.

In 2024, European companies must apply for the first time a whole set of European CSR regulations. A historical push with the purpose of encouraging a more responsible business conduct.

About Positivéco

At Positivéco, we see new national and international CSR regulations as vectors for positive growth.

Our job: to improve the readability of your activities for better valuation.

Since 2009, we have been supporting financial institutions, public players, and listed and unlisted companies in the evaluation of their CSR policies, the production of their extra-financial reporting and the implementation of their climate investment and aid projects. Development.

Make an appointment today and find out how to meet the new requirements of economic transparency while serving the project of your company.

Contact us now!