The CBAM is one of the most innovative and ambitious pieces of legislation in the European Union.

The CBAM, Europe’s first border carbon tax, has entered its test phase.

What stage has Europe reached in the vast project to create the first WTO-compatible border carbon tax?

We are at the beginning of the transitional phase, which will last until the end of 2025.

The CBAM, Europe’s first border carbon tax, has entered its test phase.

What stage has Europe reached in the vast project to create the first WTO-compatible border carbon tax?

We are at the beginning of the transitional phase, which will last until the end of 2025.

The CBAM is one of the most innovative and ambitious pieces of legislation in the European Union.

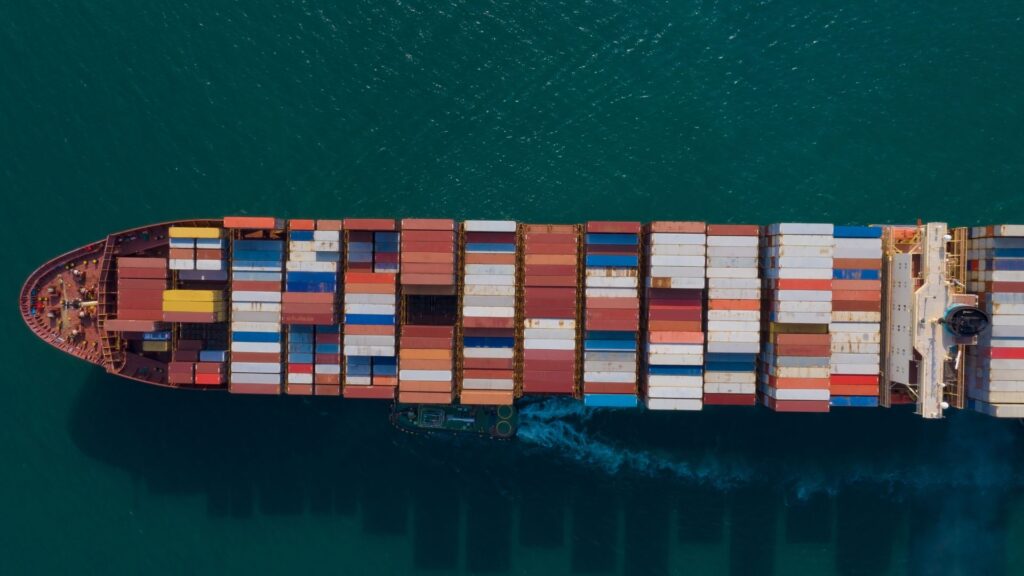

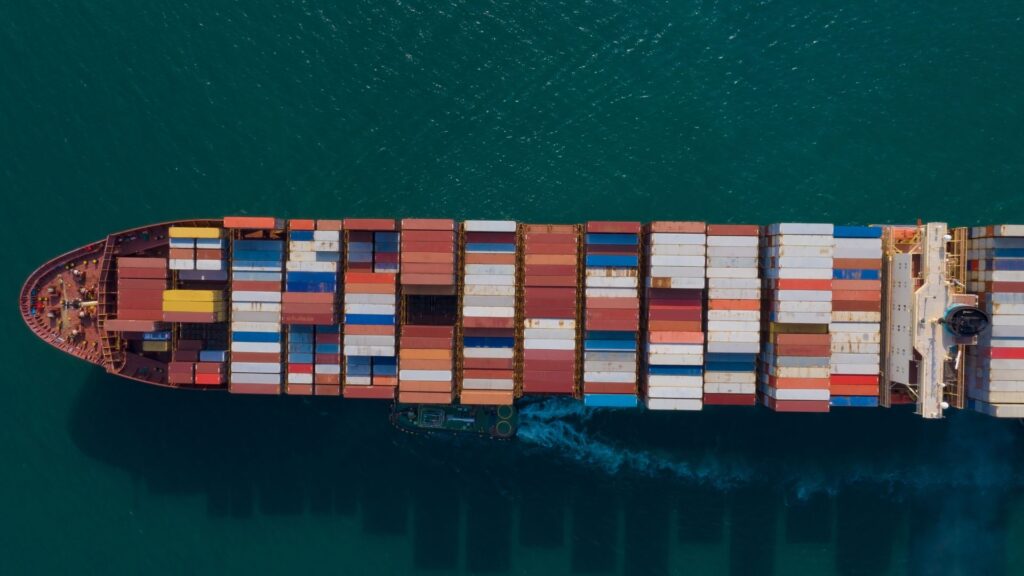

This border carbon tax is an environmental protection mechanism designed to tax imported emissions at the European carbon price.

What is the CBAM?

On 22 June 2022, the European Parliament voted to create a Carbon Border Adjustment Mechanism (CBAM).

The creation of this border carbon tax is one of the tools in the Fit for 55 package which, along with the reform of the Emissions Trading Scheme and the new Social Climate Fund, should enable Europe to achieve carbon neutrality by 2050 at the latest. It is an environmental protection mechanism designed to tax imported emissions at the European carbon price and reduce the risks of relocation to free-riding countries.

What is the CBAM?

On 22 June 2022, the European Parliament voted to create a Carbon Border Adjustment Mechanism (CBAM).

The creation of this border carbon tax is one of the tools in the Fit for 55 package which, along with the reform of the Emissions Trading Scheme and the new Social Climate Fund, should enable Europe to achieve carbon neutrality by 2050 at the latest. It is an environmental protection mechanism designed to tax imported emissions at the European carbon price and reduce the risks of relocation to free-riding countries.

This border carbon tax is an environmental protection mechanism designed to tax imported emissions at the European carbon price.

The carbon cost of imported emissions will be paid by the exporter, based on the average weekly price of European allowances.

How does the CBAM work?

The carbon cost of imported emissions will be paid by the exporter, based on the average weekly price of European allowances and taking into account any carbon cost already paid in the country of origin.

In order to succeed, the ecological protectionism project at the borders must be diplomatically and economically acceptable. It will not work without consultation between the states.

Moreover, the regulation commits the Commission to undertaking the creation of an international climate club or “carbon club”, which could be placed under the governance of an institution such as the WTO or the OECD, which are already openly in favour of this principle. The G7 has since created its own climate club.

How does the CBAM work?

The carbon cost of imported emissions will be paid by the exporter, based on the average weekly price of European allowances and taking into account any carbon cost already paid in the country of origin.

In order to succeed, the ecological protectionism project at the borders must be diplomatically and economically acceptable. It will not work without consultation between the states.

Moreover, the regulation commits the Commission to undertaking the creation of an international climate club or “carbon club”, which could be placed under the governance of an institution such as the WTO or the OECD, which are already openly in favour of this principle. The G7 has since created its own climate club.

The carbon cost of imported emissions will be paid by the exporter, based on the average weekly price of European allowances.

What sectors are covered by the CBAM?

The goods covered include steel, refining, cement, aluminium, basic organic chemicals, hydrogen, polymers and fertilisers.

What sectors are covered by the CBAM?

The goods covered include steel, refining, cement, aluminium, basic organic chemicals, hydrogen, polymers and fertilisers.

Are the new CBAM rules known?

No, not in their entirety. The CBAM (Carbon Border Adjustment Mechanism) is one of the most innovative and ambitious pieces of legislation in the European Union. Numerous implementation rules need to be finalised by 2025, notably concerning the calculation of imported emissions and verification and accreditation mechanisms.

Are the new CBAM rules known?

No, not in their entirety. The CBAM (Carbon Border Adjustment Mechanism) is one of the most innovative and ambitious pieces of legislation in the European Union. Numerous implementation rules need to be finalised by 2025, notably concerning the calculation of imported emissions and verification and accreditation mechanisms.

Importing companies must make their first customs declaration at the end of January 2024 for the 3-month period ending on 31 December 2023.

Do European importers and their foreign suppliers have to take any steps?

Importing companies do not have all the cards in their hand, but they must make their first customs declaration at the end of January 2024 for the 3-month period ending on 31 December 2023, on the basis of transitional rules.

Do European importers and their foreign suppliers have to take any steps?

Importing companies do not have all the cards in their hand, but they must make their first customs declaration at the end of January 2024 for the 3-month period ending on 31 December 2023, on the basis of transitional rules.

Importing companies must make their first customs declaration at the end of January 2024 for the 3-month period ending on 31 December 2023.

The additional cost of a product can be as much as 50% of its value.

How can you understand this novel mechanism and secure your international trade operations?

We propose to help you simulate the basis of imported/exported emissions covered by the CBAM. The additional cost of a product can be as much as 50% of its value. It’s best to get to grips with this new parameter so that you can incorporate it into your commercial negotiations and avert a major financial risk.

How can you understand this novel mechanism and secure your international trade operations?

We propose to help you simulate the basis of imported/exported emissions covered by the CBAM. The additional cost of a product can be as much as 50% of its value. It’s best to get to grips with this new parameter so that you can incorporate it into your commercial negotiations and avert a major financial risk.

The additional cost of a product can be as much as 50% of its value.

About Positivéco

At Positivéco, we see new national and international CSR regulations as vectors for positive growth.

Our job: to improve the readability of your activities for better valuation.

Since 2009, we have been supporting financial institutions, public players, and listed and unlisted companies in the evaluation of their CSR policies, the production of their extra-financial reporting and the implementation of their climate investment and aid projects. Development.

Make an appointment today and find out how to meet the new requirements of economic transparency while serving the project of your company.

Contact us now!