ESMA published a Supervisory Briefing that develops guidelines to combat greenwashing by creating common supervisory criteria for national supervisory authorities.

Part five

The European Securities and Markets Authority (ESMA) has identified the risk of an increase in greenwashing linked to European regulations and wants to address this.

ESMA unveiled in February 2022 its Sustainable Finance Roadmap 2022-2024: one of the three priorities is the fight against greenwashing and the promotion of transparency . In our previous article, How to ward off the threat of greenwashing and protect your reputation in the long term?, we mentioned how the regulator wanted to precisely define the phenomenon of greenwashing and ensure clarity and harmonisation of the SFDR, Taxonomy and CSRD regulations.

On 31 May 2022, ESMA also published a Supervisory Briefing as a guide for the supervision of financial products affected by the SFDR and Taxonomy regulations. The document develops guidelines to combat greenwashing by creating common supervisory criteria for national supervisory authorities. The briefing highlights the risks associated with the difficult articulation between SFDR and Taxonomy and is in several respects more detailed and stricter than the legal texts and RTS.

This document can serve as a guide for market participants preparing for the upcoming reporting deadlines as well as a guide for investors who want to know how to separate the wheat from the chaff.

The supervisor will carry out follow-up actions, notably by sending out and using a questionnaire, and will then carry out a SPOT inspection campaign.

From 2023 onwards, the AMF will also carry out initial inspections of documents published by asset managers.

On 9 January the AMF published its priorities for action and supervision (please note the documents are in French language) for the year and plans to participate in ESMA’s coordination exercise on the application of the SFDR Regulation. The supervisor will carry out follow-up actions, notably by sending out and using a questionnaire, and will then carry out a SPOT inspection campaign. These consist in short, thematic inspections conducted by the AMF at a panel of asset management companies to compare the practices of market participants regarding the implementation of regulations in the area concerned.

SPOT checks on ESG issues were also initiated in 2022 and renewed for 2023 to strengthen the reliability of the mechanisms implemented by management companies to comply with their contractual ESG commitments.

Faced with the attraction of sustainable products for investors and the acceleration of regulatory obligations related to sustainable finance, the challenge for management companies and asset managers is considerable.

The appropriation of this new regulatory framework remains complex for market players who are dependent on the availability of reliable non-financial data.

Faced with the attraction of sustainable products for investors and the acceleration of regulatory obligations related to sustainable finance, the challenge for management companies and asset managers is considerable. Appropriating this profusion of technical texts requires significant resources and training for managers. Market players who have not already developed or acquired know-how and tools in the field of responsible investment over several years may feel overwhelmed. They also depend heavily on the availability and reliability of extra-financial data to be able to produce the figures required by the regulations and expected by their clients. The transparency work carried out by issuers for many years now should enable managers to conduct a constructive dialogue and meet their own transparency obligations.

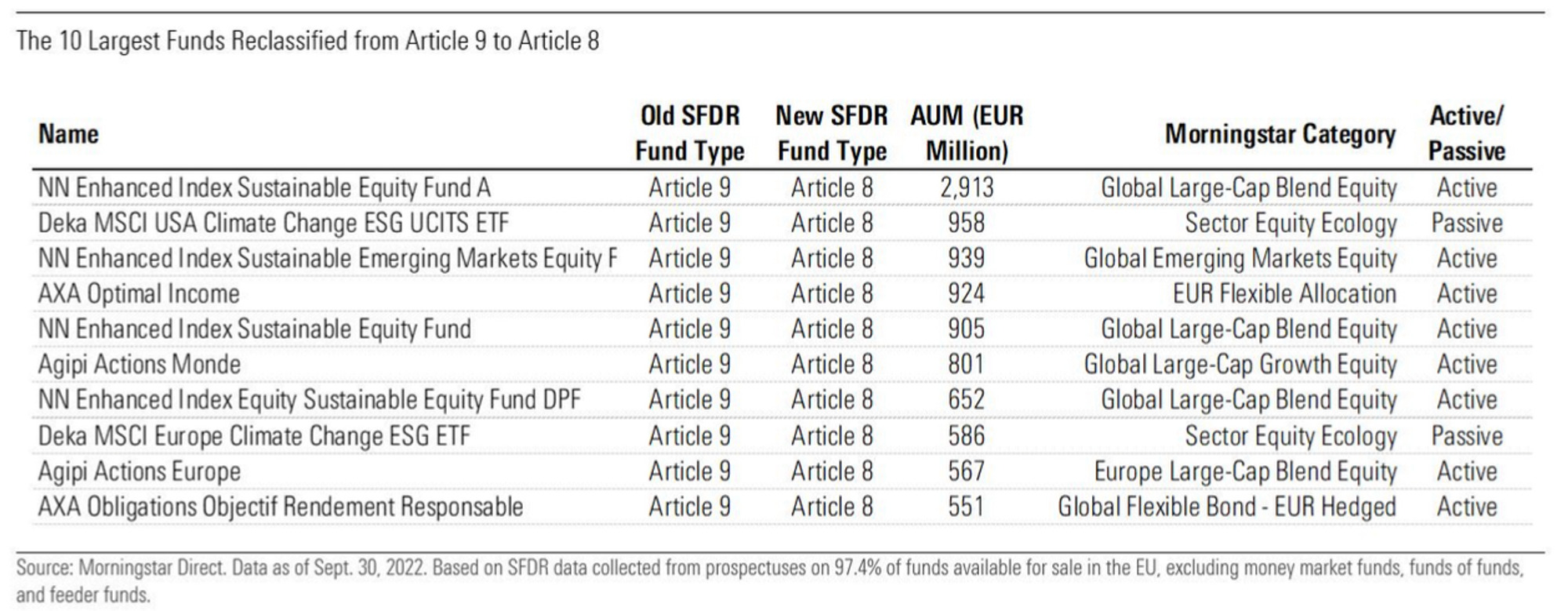

10 largest funds voluntarily reclassified from Article 9 to Article 8

INTERESTED IN KNOWING MORE?

- SPOT inspection campaign by the AMF: 3 priorities to improve sustainability commitment compliance by asset management companies

- The SFDR regulation: instructions for use (part 1)

- The SFDR regulation: instructions for use (part 2)

- The SFDR regulation: instructions for use (part 3)

- The SFDR regulation: instructions for use (part 4)

About Positivéco

At Positivéco, we see new national and international CSR regulations as vectors for positive growth.

Our job: to improve the readability of your activities for better valuation.

Since 2009, we have been supporting financial institutions, public players, and listed and unlisted companies in the evaluation of their CSR policies, the production of their extra-financial reporting and the implementation of their climate investment and aid projects. Development.

Make an appointment today and find out how to meet the new requirements of economic transparency while serving the project of your company.

Contact us now!