These two new standards define how a company discloses information about sustainability-related factors that may enhance or detract from a company’s ability to create value.

This exercise requires identifying the main internal and external risks, testing the sensitivity to different scenarios, and reporting on them periodically.

In 2022, IFRS(*) lays the foundation for new financial reporting standards that include the sustainability dimension.

The drafts of the first two IFRS Sustainability 1 (material sustainability issues) and IFRS Sustainability 2 (focus on climate-related information) have already been subject to a consultation period on the IFRS website which ended on 29 July 2022. IFRS expects them to be finalised and published by the end of 2022.

Concretely, what is really at stake for your business? Simply put, its VALUE.

These two new standards define how a company discloses information about sustainability-related factors that may enhance or detract from a company’s ability to create value.

The aim is to present comprehensive financial information that takes into account the impact of emerging risks, including climate-related risks, on the amounts and disclosures normally presented in financial statements. The total value of the company is the sum of the (market) value of its equity and its net debt.

Potential implications for the value of the business may include impairment of its assets, including goodwill, changes in their value in use and changes in their fair values.

In practice, this exercise requires identifying the main internal and external risks, testing the sensitivity to different scenarios, and reporting on them periodically. To do this, the company needs to define an operational environmental and social management framework that informs the company’s governance of its non-financial performance in real time.

Climate change poses a systemic financial risk to the global economy.

These new standards are built on frameworks and initiatives that have been in place for many years.

- In Europe, the European Directive on Non-Financial and Diversity Information Disclosure (2014/95/EU) (NFRD) in application since 2014 introduced the obligation for the 12,000 largest companies in the Member States to publish non-financial statements annually (the Extra-Financial Performance Declaration (DPEF) in France) and to articulate them with financial information in a consistent and relevant manner. This information covers the themes of environmental performance, social performance, employees and diversity, respect for human rights, the fight against corruption and the fight against tax evasion.

- Since 1997, based in Amsterdam, the Global Reporting Initiative(*), has carried out a colossal amount of work to standardise non-financial data and to disseminate its voluntary standards on all continents. The GRI guidelines cover the three dimensions, economic, environmental and social. With the current revision of the NFRD, the GRI’s work is set to become one of the benchmarks imposed in future European reporting obligations.

- Each year, CDP (*), the voluntary reporting platform on climate, forest and water issues, dedicated to listed companies, carries out an integration and updating work that reflects the specific expectations of investors for each vertical topic. The platform collects data and information from companies on governance, strategy and financial planning, risk and opportunity management, impact measurement, target setting, and commitment to transforming the company internally and across its value chain on identified priorities.

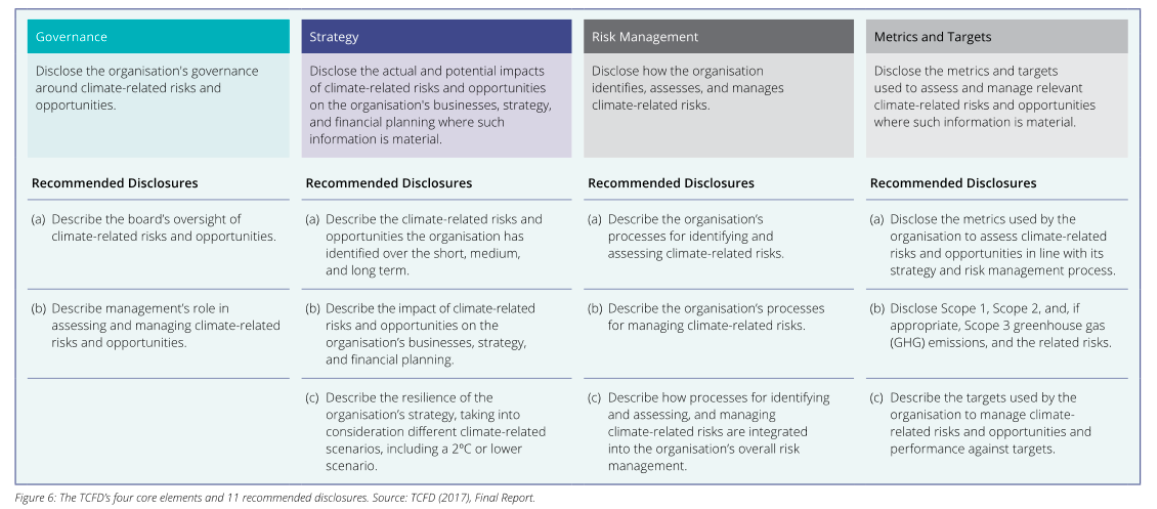

- In 2015, recognising that climate change poses a systemic financial risk to the global economy, the Financial Stability Board established a Task Force on Climate-related Financial Disclosures (the TCFD (*)) to develop a set of voluntary and consistent disclosure recommendations for companies. Indeed, in order to limit uncertainty, financial markets need clear, comprehensive and high quality information on the effects of climate change. This includes the risks and opportunities presented by rising temperatures, climate-related policies and emerging technologies.

The 11 recommendations resulting from the work of the TCFD now constitute a reference and a methodological starting point for all think tanks interested in the transition to a more resilient economy.

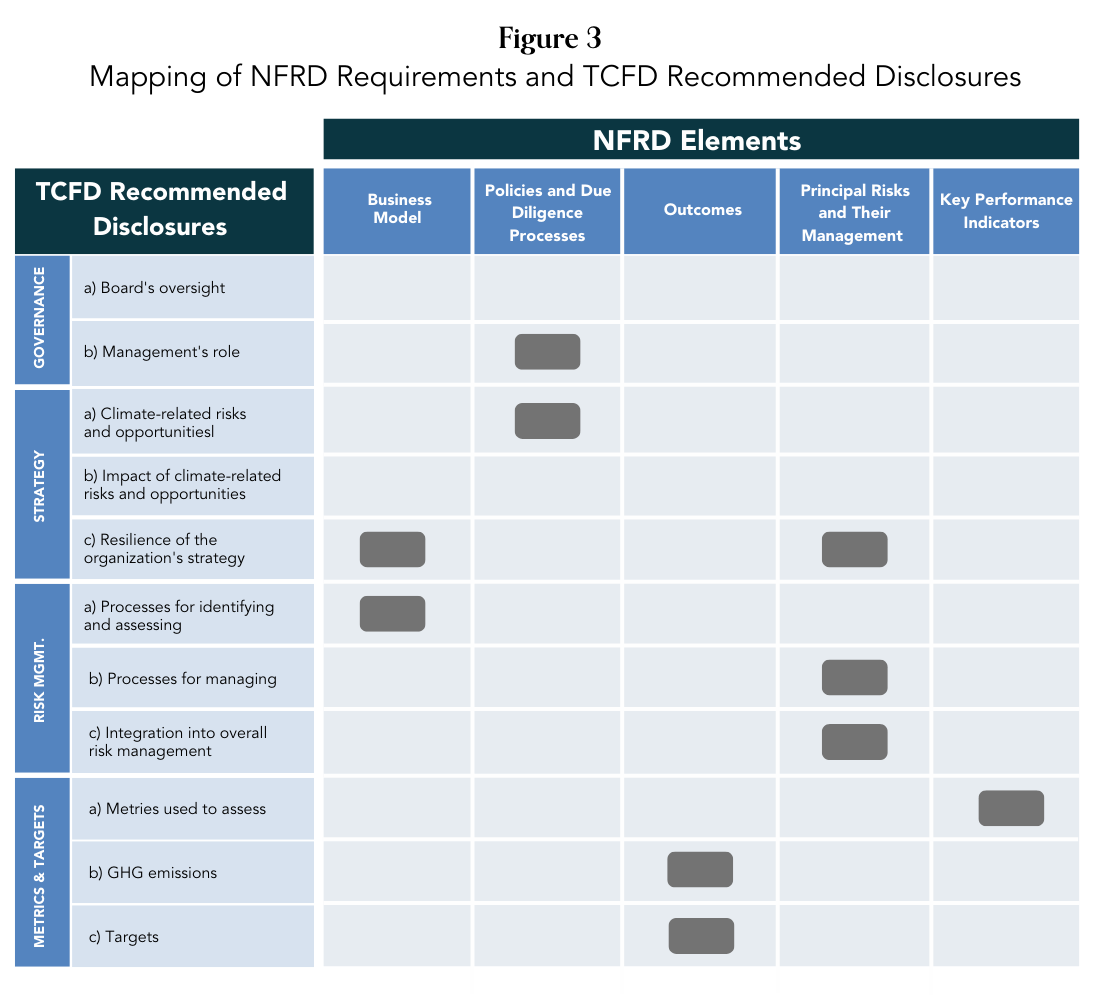

Thus, the European Commission has taken care to ensure that its NFRD covers the TCFD recommendations (Source: European Commission Guidelines on reporting climate-related information – Non financial reporting directive (NFRD) and the CDP refers to it explicitly throughout its Climate Questionnaire.

-

- At the end of 2020, the 5 main players (CDP, CDSB(*), GRI, SASB(*), and IIRC(*)) that have helped to demonstrate the existence of a market for non-financial reporting, but probably without reaching critical size, have come together to produce a common reporting template

- At the end of 2021 and during 2022, consolidation will accelerate. This time the IFRS Foundation is creating its own non-financial information standards board (the International Sustainability Standards Board, or IISB(*), and is preparing to absorb the work of the SASB, IIRC and CDSB.

IFRS S2, dedicated to climate-related financial reporting, goes further imposing the “comply or explain” principle.

The disclosure of the same data in financial statements will require more attention and documentation and needs to be prepared for, now.

With the “Sustainability” standards, IFRS imposes a financial vision of sustainable development.

We believe that IFRS S1 is a very accessible general foundation for companies that are already applying IFRS and therefore probably subject to non-financial reporting obligations or applying GRI standards. These companies thus have a knowledge of their material issues and an adapted risk management, reflected in their universal registration documents or annual reports.

IFRS S2, dedicated to climate-related financial reporting, goes further than general practice by requiring disclosure of specific, standardised and forward-looking quantitative data and information, imposing the “comply or explain” principle, in particular with regard to:

- Disclosure of the company’s low-carbon transition plan and specific information on the possible use of offsets. This includes information on how the company plans to meet its climate goals (including information on the use of carbon offsets), its plans and critical assumptions for legacy assets, and quantitative and qualitative information on the progress of previously published plans,

- A description of the effects of significant climate-related risks and opportunities on the company’s financial position, financial performance and cash flows for the reporting period, and the expected effects in the short, medium and long term – including how climate-related risks and opportunities are factored into financial planning,

- The presentation of the results and the method used (climate scenario analysis or an alternative technique) for the company’s analysis of the resilience of its strategy to climate-related risks,

- Disclosure of seven categories of cross-cutting metrics common to all companies and mandatory: greenhouse gas (GHG) emissions on an absolute and intensity basis; transition risks; physical risks; climate opportunities; capital deployment in relation to climate risks and opportunities; internal carbon prices; and percentage of executive compensation related to climate considerations

- The imposition of the GHG Protocol as a methodology for measuring GHG emissions,

- Disclosure of Scope 3 emissions including upstream and downstream,

- Disclosure of information on emission reduction targets, including the purpose of the target (e.g. mitigation, adaptation, or compliance with sectoral or scientific initiatives), as well as information on how the entity’s targets compare to those prescribed in the latest international climate change agreement.

Companies used to respond to CDP climate campaigns will be well prepared. However, CDP responses remain relatively confidential, whereas the disclosure of the same data in financial statements will require more attention and documentation and needs to be prepared for, now.

Conclusion

The arrival of the new IFRS Sustainability 1 and Sustainability 2 standards is the culmination of initiatives to integrate the non-financial dimension into corporate financial communication, previously led by various associations representing the economic world and civil society. Mandatory in 146 jurisdictions, the IFRS standards will accelerate this movement at the risk of placing certain insufficiently prepared companies in a delicate situation.

Good practices exist. So does the risk of dispersion. Compliance with these new requirements must follow a methodology that meets investors’ expectations and the company’s operational reality.

For more than 10 years, we have been helping our clients to secure their projects. We create their non-financial reporting framework, on risks, trends and regulations. Management teams have a real-time view of their non-financial performance. The company can gain visibility and project itself into the future.

Notes:

CDP: NGO based in the UK and continental Europe with an international presence.

CDSB: the Climate Disclosure Standards Board is a consortium of companies and NGOs, recently consolidated into the IFRS Foundation.

GRI: The Global Reporting Initiative is the world’s leading standard-setting body for stakeholder-driven sustainability reporting. Its standard-setting body has signed a cooperation agreement with the IISB.

IFRS: The International Financial Reporting Standards (IFRS) Foundation is a not-for-profit public benefit organisation established to develop a single set of high-quality, understandable, enforceable and globally accepted sustainability accounting and reporting standards and to promote and facilitate the adoption of these standards.

IIRC: International Integrated Reporting Council, merged with SASB into the Value Reporting Foundation, recently consolidated into the IFRS Foundation.

ISSB: The newly formed International Sustainability Standards Board is the standard-setting body for IFRS sustainability reporting.

SASB: Sustainability Accounting Standards Board (SASB), merged with IIRC to form the Value Reporting Foundation.

TCFD: Taskforce on Climate related Financial Disclosure was established by the Financial Stability Board in 2015 to develop a set of voluntary and consistent disclosure recommendations for companies to use in providing information to investors, lenders and insurance underwriters, on their climate related financial risks.

About Positivéco

At Positivéco, we see the new national and international regulations on CSR as an opportunity for positive growth.

Our aim: to apply financial and commercial skills to structure projects outside the traditional silos.

Since 2009, we have been supporting climate investment and development aid projects; we evaluate CSR policies and carry out extra-financial reporting for our clients. Positivéco advises financial institutions, public actors, listed and non-listed companies.

Request a callback today and discover how you can meet the new CSR requirements while serving the company’s project.

Who we are

With Positivéco, your success is our priority. Since our conception, we have always applied financial and commercial expertise outside the traditional silos, to structure successful and impactful client projects. This improves the visibility of your activities for enhanced profitability and increases your financial valuation.

Contact us now!