The Paulson Institute puts forward solutions based on the opening of markets, finance and green finance, the heart of its area of influence.

What is the Paulson Institute and what is its mission?

Created in 2011, the Paulson Institute presents itself as a “think and do tank” dedicated to promoting a U.S.-China relationship that can help maintain order in an ever-changing world.

Its founder, Hank Paulson, describes the Paulson Institute as a non-partisan, independent, privately funded think tank and action group, not supported by or linked to any government. The institute focuses its activity on Sino-American relations, considering it the most important bilateral relationship in the world.

The Paulson Institute puts forward solutions based on the opening of markets, finance and green finance, the heart of its area of influence that it manages to exert on this continent.

Hank Paulson now divides his time between the “think and do tank” and his other commitments.

Who is Hank Paulson, founder of the Paulson Institute?

Hank Paulson spent 30 years of his career at Goldman Sachs developing the bank’s presence in China, then heading the company as CEO from 1999. Hank Paulson also served as Secretary of the Treasury under the Bush administration, overseeing the nation’s response to the 2008 financial crisis.

Former Chairman of the Board of The Nature Conservancy, Hank Paulson now divides his time between the “think and do tank” and his other commitments: he is Executive Chairman of TPG Rise Climate, the climate investment platform of private equity firm TPG, Co-Chairman of the Economic Strategy Group of the Aspen Institute and Co-Chairman of the Advisory Board of the Bloomberg New Economy Forum.

Its work promotes market-based solutions to ensure sustainable economic growth.

The Paulson Institute prepared the Financing Nature report, which probably played a fundamental role in the adoption of the ambitious Kunming Global Biodiversity Framework in Montreal.

What solutions is the Paulson Institute proposing ?

The Paulson Institute proposes solutions at the intersection of economics, financial markets and environmental protection. Its work promotes market-based solutions to ensure sustainable economic growth. The think and do tank is committed to decoding China’s political economy, supporting market-based solutions to climate change, partnering with financial markets to implement green finance standards and championing innovative approaches to financing low-carbon growth.

The Institute’s campaigns have major implications for opening up new ‘green’ financial markets.

Alongside The Nature Conservancy and the Cornell Atkinson Center for Sustainability, the Paulson Institute prepared the Financing Nature report, which probably played a fundamental role in the adoption of the ambitious Kunming Global Biodiversity Framework in Montreal. In particular, the report advocates the use of the market to finance the achievement of global environmental goals. According to the report, the $700 billion funding shortfall for biodiversity conservation could be mobilized by placing the value of natural capital at the heart of economic models and implementing a set of financial and public policy mechanisms, subsequently included in the Kunming-Montreal convention.

China estimates that achieving its green economy goals will cost up to $1,000 billion a year.

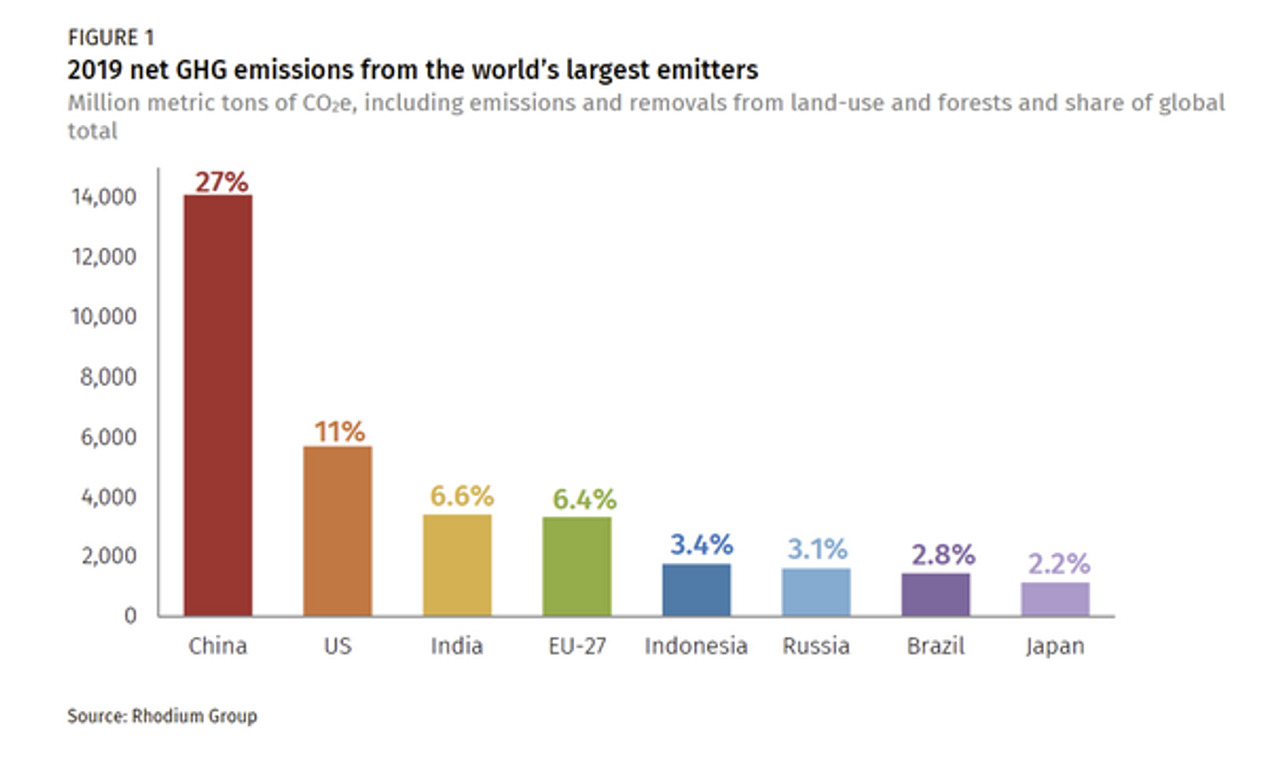

Where does China rank among the world’s GHG emitters?

Responsible for 27% of the world’s carbon dioxide and a third of the planet’s greenhouse gases, China is a crucial player in the success of the transition. The World Bank points out in its Country Climate and Development Report that it will be impossible to achieve global climate targets without China’s successful transition to a low-carbon economy. China estimates that achieving its green economy goals will cost up to $1,000 billion a year, but the government is only able to cover 15% of these costs.

Source: Rhodium Group

The Institute acts as a non-commercial advisor to the U.S.-China Green Fund, a public-private partnership initiated in 2015 to invest in low-carbon clean technologies and foster cooperation between the two countries in terms of green innovation.

How is the Paulson Institute promoting green finance in China?

As part of its work to promote green finance in China, the Institute acts as non-commercial advisor to the U.S.-China Green Fund, a public-private partnership initiated in 2015 to invest in low-carbon clean technologies and foster cooperation between the two countries in terms of green innovation.

The Paulson Institute also relays the many advances in green finance in China, including in 2022:

- the launch of the first investment fund dedicated to zero-carbon technology by IDG Capital,

- the publication by Huzhou of the first regional roadmap for the development of transition financing,

- the issue of the first batch of green bonds specialized in the marine economy by the Shenzhen stock exchange,

- the issue of the first carbon-neutral green CMBS by the Shanghai and Beijing Stock Exchanges,

- the entry into force of China’s first ESG reporting directive for companies,

- the publication of the “China Green Bond Principles”,

- Shanghai’s first regulations dedicated to green finance, the “Shanghai Pudong New Area Green Financial Development Regulations”,

- the introduction in Huzhou of the first institutional framework for regional financial support for biodiversity conservation,

- the issue of the first carbon-neutral green bond by Haitong Securities.

The Paulson Institute’s think tank, MacroPolo, is dedicated to analyzing the Chinese market through three filters: economics, technology and politics.

China is presented as the leader in terms of production capacity, natural resources and exports.

An unprecedented vision of the world after the transition to new energies.

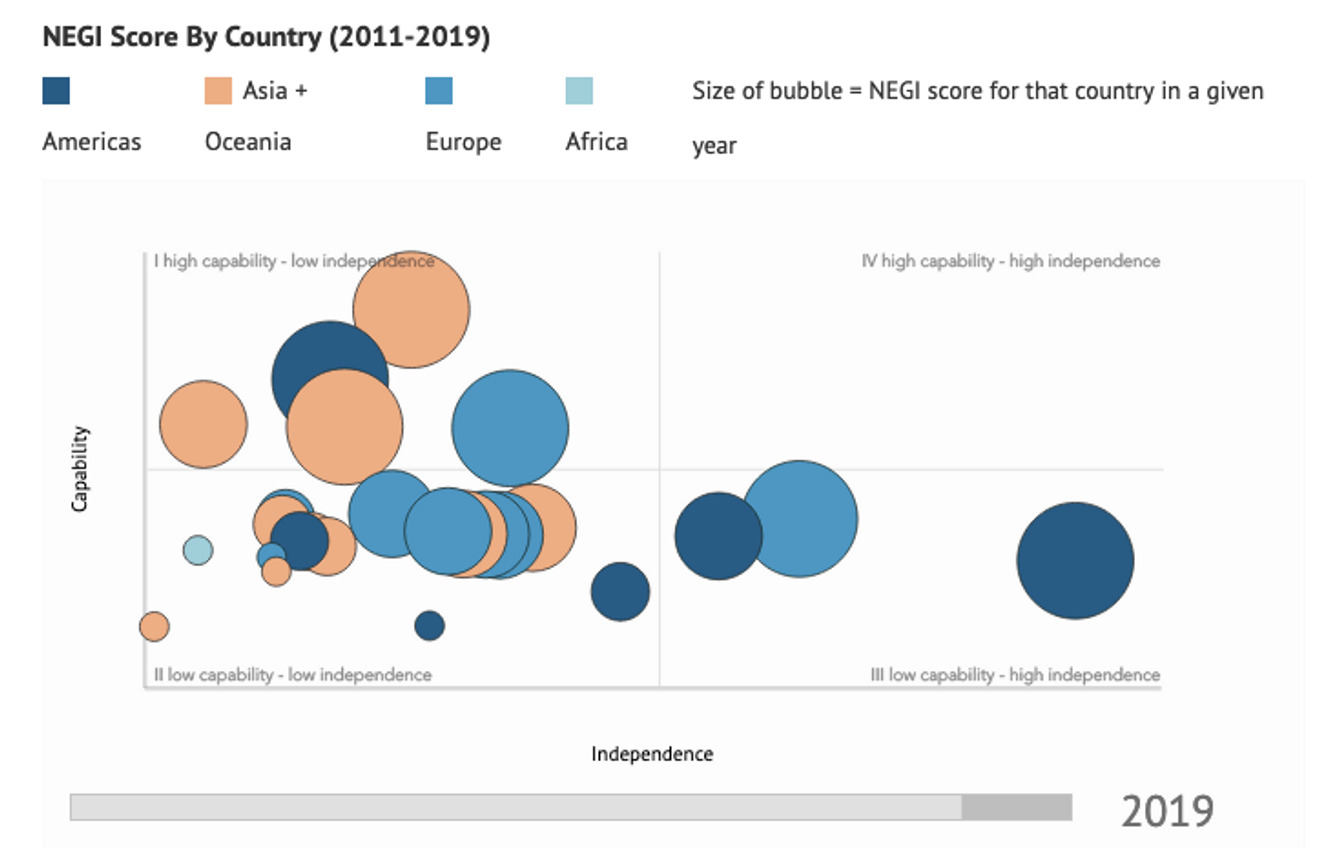

The Paulson Institute’s think tank, MacroPolo, is dedicated to analyzing the Chinese market through three filters: economics, technology and politics. In particular, Macropolo has created the New Energy Geopolitics Index (NEGI), which aims to analyze the geopolitical turning point linked to the energy transition.

Covering 25 countries over the period 2011-2019, the NGEI provides a score assessing the potential geopolitical influence of each country following the global transition from fossil fuels to renewable energies. The index places China in a good position on its matrix, whose criteria are the country’s capacity in the climate technology value chain and its independence from fossil fuels.

China is presented as the leader in terms of production capacity, natural resources and exports. The Macropolo website provides more information on NEGI and the new geopolitics of new energies. China must continue to welcome foreign investment.

The Paulson Institute’s conservation program focuses on three priority biodiversity conservation areas.

The Paulson Institute’s final area of focus is environmental conservation.

The Paulson Institute’s conservation program focuses on three priority biodiversity conservation areas:

- wetlands,

- national parks,

- responsible trade and investment.

The initiative supports the protection of China’s natural coastline, works to shape a new model for the country’s protected areas, and promotes the reduction of the overall environmental impact of China’s overseas investment and international commodity trade.

Benefiting from its founder’s experience and relationships with the leaders of the world’s biggest polluter, the Paulson Institute has become an influential, pro-American player in financing the energy transition, stepping into the breach opened up by international governance that is running out of steam.

About Positivéco

At Positivéco, we see new national and international CSR regulations as vectors for positive growth.

Our job: to improve the readability of your activities for better valuation.

Since 2009, we have been supporting financial institutions, public players, and listed and unlisted companies in the evaluation of their CSR policies, the production of their extra-financial reporting and the implementation of their climate investment and aid projects. Development.

Make an appointment today and find out how to meet the new requirements of economic transparency while serving the project of your company.

Contact us now!